Your credit score vs. credit report

Learn the difference between a credit score and a credit report — and who will be checking each.

You’re good at saving money, so you’ll have no problem taking out a loan to buy a car or a house, right? Not exactly. Banks, landlords, and even employers may look at your credit to determine if you’re likely to be financially responsible.

But your credit score is different than your credit history. Read on to learn more about credit scores, credit history, and when each is checked.

What is my credit score?

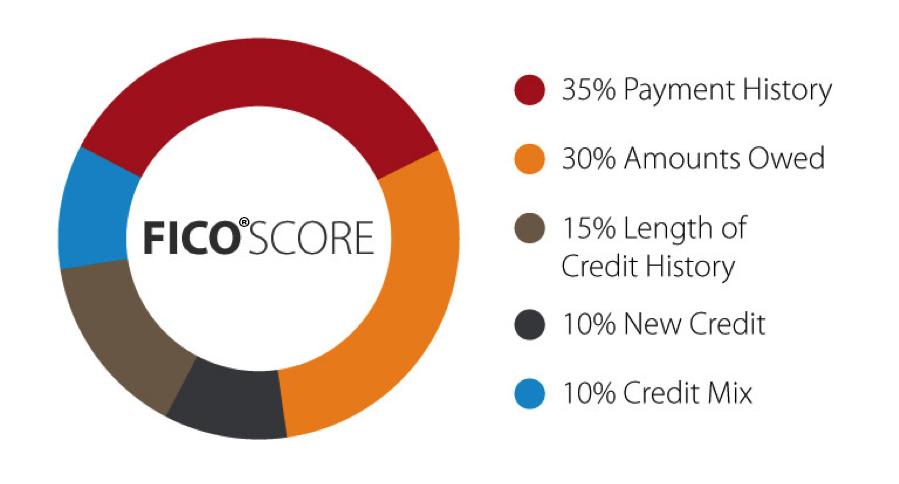

Your credit score is a three-digit number based on data on your credit report and the higher your score, the better. The most commonly used score is the FICO® Credit Score. It’s calculated with the following categories:

Who will check my credit score — and when?

The credit score most often pulled by lenders is your FICO® Score. Specific examples of when your score will be pulled include:

- When you’re applying to get a credit card

- When you’re looking to buy a house or rent an apartment

- When you’re requesting a loan to buy a car

What is my credit history/credit report?

Say you had a few blunders in college (like consistently late bill payments), but your credit score is high now. Your credit history, which is compiled in a credit report, will show these blunders, but also your improvements. In this way, your credit score is like a single final grade for the semester; your credit history is a record of every test, quiz, and homework score that contributed to that final grade.

Who will check my credit history/credit report?

Similar to your score, your credit report will be checked if you apply to rent an apartment or take a loan out on a house or car. However, you should also be prepared for your credit history to be checked on a few other occasions:

- When you sign up for insurance. Car, home, health, and life insurance providers all have the right to check your credit report.

- When you get a new job. Employers have access to modified credit reports created by reporting agencies. To protect your financial security and meet Equal Employment Opportunity laws, these modified reports omit your account numbers, year of birth, and references to your spouse. Many employers will pull credit reports as part of their background check on employees before hiring.

- If you default on loan or credit card debt. Collection agencies are able to pull your credit report to obtain information in connection with the collection of debt.

Hard vs. soft inquiries

You may have heard that numerous pulls to view your credit score may lower your credit: That’s partially correct. Hard credit inquiries happen when a lender checks your report to make a lending decision. Too many hard inquiries can slightly lower your score, but will only stay on your report for two years.

Some examples of hard inquiries from MyFICO.com include:

- When you’re buying a car and apply for financing at the car dealership.

- When you respond to a credit card offer in the mail.

- When you request a credit line increase from your credit lender. The company pulls a fresh credit report on you to help determine if they will grant the increase.

When other parties, such as employers and insurance agencies check your credit report, it will likely be pulled as a soft inquiry, which has no effect on your credit score or history.

Some examples of soft inquiries from MyFICO.com include:

- When you pull a copy of your own credit report from one of the three credit reporting agencies.

- When you get a new job and your employer pulls your credit report as part of its new employee screening process.

Credit Close-Up® offers eligible Wells Fargo Online® customers complimentary access to their FICO® Score¹, credit monitoring alerts, and more.