Your summer savings plan

Make your finances easier next school year by setting a goal to help you save more cash over the summer.

A busy class schedule, hours of studying, and a plethora of extracurricular activities can make earning money during the school year challenging. Saving over the summer could be your best course of action to help prepare for next year’s expenses — especially if you are considering how to pay for college or if you are borrowing money to cover college costs. Here are five actions you can take to help you put your summer earnings to good use.

1. Determine what you’re saving for

All great plans start with a goal. At the beginning of your summer savings journey, start with determining why you need to save money. Are you trying to cover the cost of tuition? Build your emergency fund? Rent your first postgrad apartment? Figuring out the “why” of your savings goal can make it easier for you to save regularly.

After you’ve identified your goal, use it to determine how much money you will need to achieve it. For example, if you’re saving to pay for school costs, you can start by adding up all the expenses you had in the spring semester. With that number, you can roughly determine how much you’ll need for the upcoming semesters. Be sure to factor in a cushion of a few hundred dollars for new or unexpected things that might be on the agenda next year (like school club dues, travel, or unplanned car repairs).

Your summer savings can give you some much-needed financial peace of mind as you head into the new school year, ready to accomplish your goals.

2. Set smaller goals

It might seem unrealistic to save the entire amount you’ll need for your savings goal in a matter of months, especially since you’ll have expenses over the summer, too. Instead, try breaking down the total amount into smaller, more achievable goals. Maybe that means you set a weekly or monthly goal for yourself. For example, how much money do you need to save per week to meet your goal by the end of the summer? How many hours of work does that come out to, figuring in any potential summer spending? This will make your overall savings target seem more manageable.

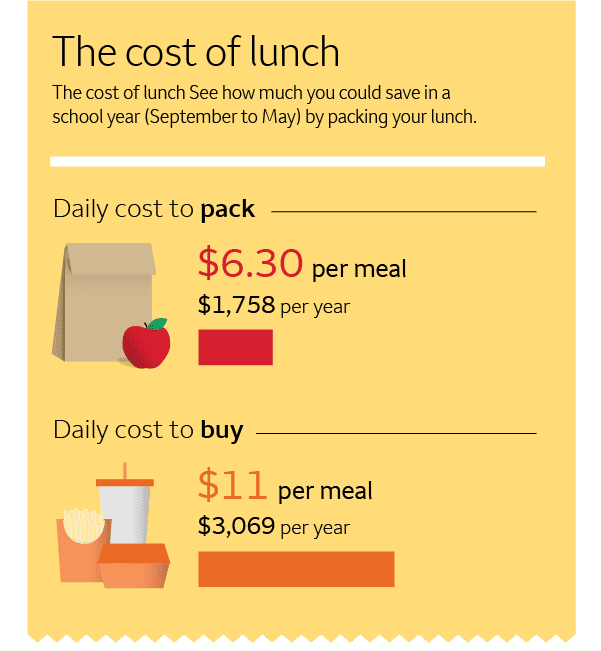

Also take a look at expenses, decide where you can spend less, and put the difference into savings. For example, if a dinner out costs $11, but you can swing by the grocery store and prepare your own meal for $6.30, you’ll have $4.70 to put into savings.

Source: “Pack Your Lunch, Pack Your Wallet: How To Save Money on Lunch at Work,” WealthFit, February 2022.

3. Figure out what to cut

If your savings goal still seems out of reach, there are a few other things you can do. You can examine your expenses, either for the summer or next year, and identify anything that you can cut back on, even just a little. Start by eliminating as much unnecessary spending as possible. If you have a Wells Fargo checking account, tools like My Spending Report with Budget Watch can help you identify areas where you may be overspending (and can cut back). Plus, there’s no fee for the tool!

4. Ask for help

If the above tips still aren’t getting you to your money-saving goal, then it may also be worth talking to your parents or other support system about the gap in meeting your savings goal and the help you need to fill it. Go into the conversation openly, honestly, and with a clear-cut plan already in place. This will not only show them that you’re being proactive about the situation, but also exactly where you’re coming up short.

41% of students say debt has been their biggest concern about attending college. One way to give yourself a cushion during the school year? Your summer savings.— The Princeton Review, 2024 College Hopes & Worries Survey Report

5. Automate your saving

Use technology to keep on track and motivated. One way to achieve your summer savings goal is to make saving automatic. If your summer job offers direct deposit, use that to help you. If that money is going into your checking account, consider setting an automatic transfer every other week or once a month from your checking account to your savings account to help you set some money aside in a place you’re less likely to touch. You can even track your progress with My Savings Plan®.

Your savings plan should make you feel empowered and excited about what’s to come. After a summer spent saving your money, you could be in a better position to head into the school year ready to accomplish goals and participate in things you enjoy.